Understanding what an entity is may sound like abstract theory, but in business and law, the term carries enormous weight. From how a company is structured to how it is taxed and regulated, the definition of entity influences everyday operations. Whether you are an entrepreneur considering a new venture, a professional navigating corporate frameworks, or a student of law, clarifying this concept can help you appreciate its reach and impact.

In this article, we will explore how the word entity is applied in different contexts, why it matters, and how the interpretation of this term shapes modern commerce and governance.

The Broad Definition of an Entity

At its simplest, an entity is something that exists independently with a distinct identity. In daily language, we use the word to describe a being, organization, or even an abstract idea. In the realm of business and law, however, it becomes much more specific.

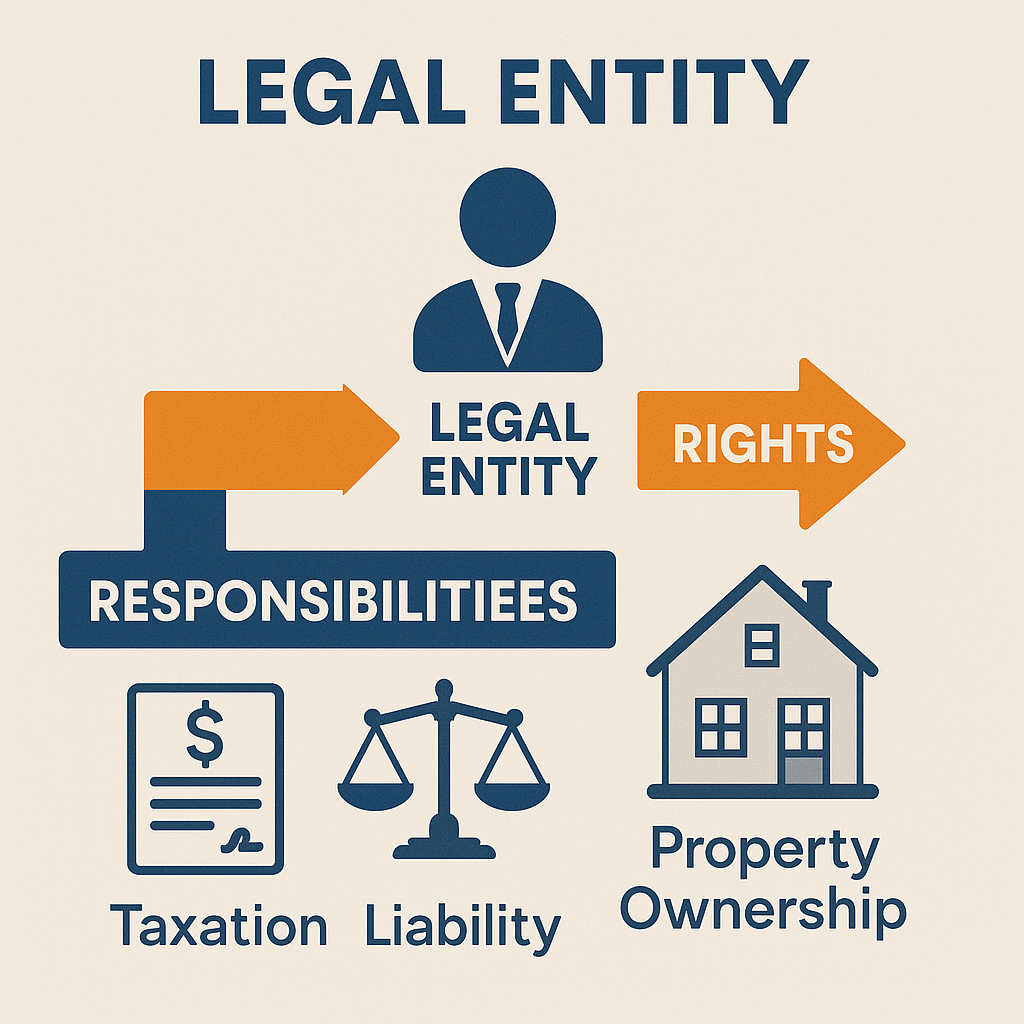

A business entity refers to a legally recognized organization or structure that exists separately from the individuals who own or manage it. A legal entity is one that has rights, duties, and responsibilities under the law. This can mean the ability to own property, enter contracts, sue or be sued, and pay taxes.

The beauty of the term is its flexibility. It may refer to a small family business, a multinational corporation, a nonprofit charity, or even a governmental body. Each type of entity carries unique implications for accountability, risk, and governance.

Business Entity: The Backbone of Commerce

When someone decides to start a business, one of the first decisions is to choose a business entity. This choice shapes taxation, liability, and management.

For example:

- A sole proprietorship is the simplest form of business entity. It is not legally separate from its owner, which means profits are taxed as personal income, but liabilities also fall directly on the individual.

- A corporation, on the other hand, is a separate legal entity. Owners (shareholders) are generally not personally liable for debts, and the organization itself is taxed.

- Partnerships and limited liability companies (LLCs) sit between these two extremes, offering varying degrees of flexibility, liability protection, and tax benefits.

The idea of an entity here is practical. It defines how a business interacts with its environment, employees, customers, and regulators. It provides clarity, but it also imposes obligations.

Legal Entity: Rights and Responsibilities

In legal language, the entity concept is indispensable. A legal entity is capable of standing before the law. That means it can sign contracts, own assets, or face penalties.

Corporations are often referred to as “legal persons.” They cannot breathe or think like humans, yet they are treated as if they have personhood in the eyes of the law. This abstraction allows courts to enforce rules, resolve disputes, and regulate businesses with consistency.

A nonprofit organization, for example, is also a legal entity. It may not operate for profit, but it can still own property, hire employees, and follow regulations. Similarly, governments themselves are entities in legal frameworks, able to enter treaties or impose obligations.

Why the Concept of Entity Matters

Without the entity concept, business and law would collapse into confusion. Imagine if every contract signed by a company required every single shareholder to appear in court or if taxes had to be individually filed by each investor in a corporation. The concept of an entity solves this problem by creating a singular, recognizable body that represents a group of people or assets.

Key reasons why it matters:

- Liability protection: Entities like corporations or LLCs shield personal assets from business debts.

- Clarity in taxation: Different entities are taxed differently, ensuring transparency and efficiency.

- Governance and control: Entities define who makes decisions and how accountability is enforced.

In short, entities bring structure to what would otherwise be chaos.

Entities in Law: A Historical Perspective

The recognition of an entity in law is not a modern invention. Ancient civilizations had versions of collective ownership and recognized groups—guilds, monasteries, or tribes—as separate from individuals.

Over time, as trade expanded, states formalized the concept. The Roman law system, for example, provided early structures for corporate-like bodies. In medieval Europe, towns and guilds enjoyed certain rights as entities. By the time modern nation-states and corporations arose, the idea was fully embedded into legal thought.

Today, courts around the world treat entities as fundamental to regulating both local and international commerce. Without this construct, modern global trade would be impossible.

Business vs. Legal Entity: Where They Intersect

It is useful to recognize that “business entity” and “legal entity” are closely related but not always identical. A business entity describes the organizational structure for operating a business. A legal entity is broader—it can refer to organizations beyond profit-driven businesses, including charities, schools, or even municipalities.

For instance, a university is a legal entity but not strictly a business entity. A small consulting firm, on the other hand, is both. Understanding this overlap prevents confusion and clarifies roles in regulation, liability, and accountability.

Entity in Practice: Real-World Examples

Consider the difference between a freelancer and a registered company. A freelancer working without a registered business is not a separate entity. They are personally liable for taxes and legal disputes.

Now, if that freelancer forms an LLC, the dynamic changes. The LLC becomes an entity in its own right, capable of entering contracts. The freelancer now enjoys liability protection, clearer tax rules, and often greater credibility.

The Risks of Ignoring Entity Structures

Failing to properly establish or recognize an entity can lead to serious consequences. Many small businesses underestimate this. Operating without creating a formal business entity exposes the owner to unlimited personal risk. If lawsuits arise, personal savings, property, or even future wages can be at stake.

Similarly, failing to treat a corporation as a separate legal entity—by mixing personal and business finances, for example—can allow courts to “pierce the corporate veil.” In such cases, liability protection dissolves, and individuals become personally accountable.

This is why accountants, lawyers, and advisors emphasize the importance of correctly managing entity structures.

Entities in the Age of Globalization

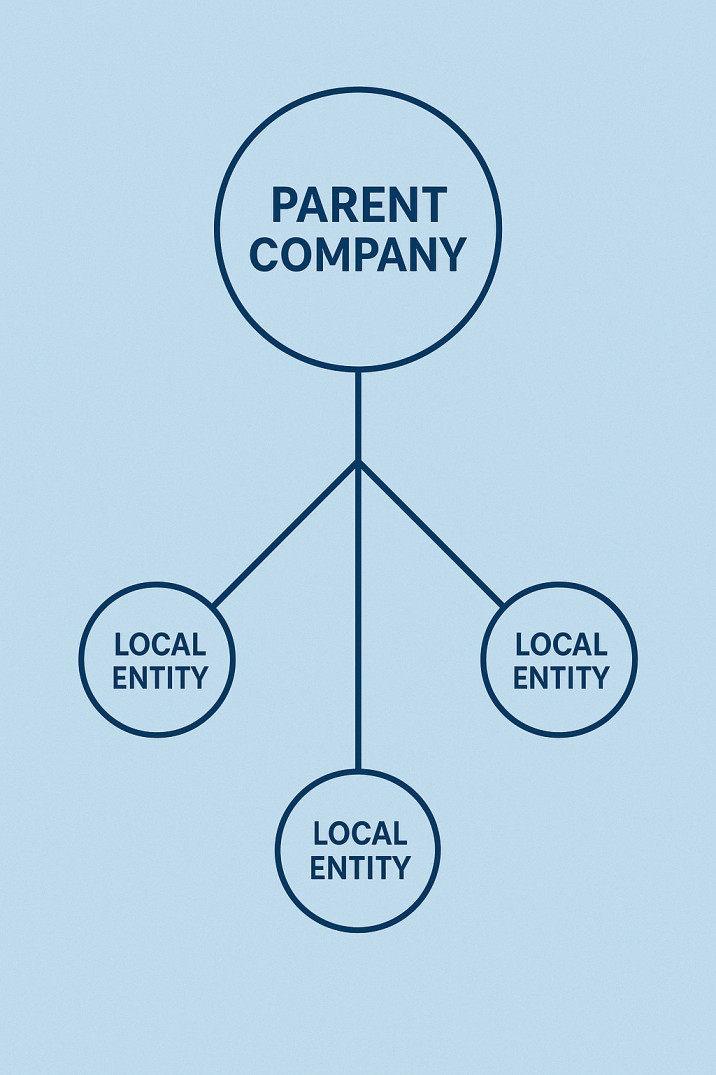

In today’s interconnected world, the concept of an entity has become even more complex. Multinational corporations operate through a web of entities across jurisdictions. Each local branch may be a separate legal entity to comply with local laws while still being part of a larger global brand.

This structure enables tax optimization, liability management, and operational efficiency. But it also creates challenges for regulators, who must ensure accountability across borders.

Future Perspectives: Digital and AI Entities?

The future may bring even more fascinating developments. As artificial intelligence becomes more capable, some legal scholars wonder whether AI systems could one day be recognized as entities with limited rights or responsibilities. Similarly, decentralized autonomous organizations (DAOs) on blockchain platforms already challenge traditional definitions by creating digital-first entities without centralized leadership.

The law is evolving, and the entity concept will likely stretch further in the decades ahead.

Conclusion

At its heart, the entity concept simplifies the complexities of human collaboration. It creates clarity, accountability, and protection in business and law. From a one-person LLC to a sprawling multinational corporation, from a small nonprofit to a government agency, entities define how groups act within society.

By understanding the meaning of entity, individuals and businesses gain the knowledge to choose the right structures, minimize risks, and thrive within the frameworks of law and commerce. It is not just a technical word—it is the foundation of modern organization.

Andrea Balint is a writer and researcher focused on human behavior, workplace psychology, and personal growth. Through her work at CareersMomentum, she explores how mindset, leadership, and emotional intelligence shape modern careers. With a background in communication and HR development, she transforms complex ideas into practical insights that help readers build clarity, confidence, and professional purpose.