Few terms carry as much weight—and as much misunderstanding—as liabilities. They often sound negative, almost like a warning sign of debt or danger. But in truth, liabilities are far more complex than that. They’re not just what a company owes; they’re a reflection of how it grows, operates, and balances risk and reward. To understand a company’s true worth, you can’t just look at its profits or assets—you must dig into its liabilities and see the story they tell about financial health, management strategy, and long-term sustainability.

Understanding liabilities means understanding the real story behind a company’s financial health. Liabilities reveal how a business manages promises, risk, and responsibility. They shape valuation, investor confidence, and long-term growth potential. Smartly structured liabilities drive innovation and stability, while unmanaged obligations weaken credibility. In 2026, analyzing liabilities helps decode not just numbers but the ethics, trust, and strategy behind a company’s true worth.

The Dual Nature of Liabilities

At their core, liabilities represent obligations. They’re the promises a company makes—to lenders, suppliers, employees, or even governments—to deliver money, goods, or services in the future. This can range from bank loans and unpaid invoices to taxes or deferred salaries. Yet, seeing liabilities purely as debt misses the point.

When properly managed, liabilities are a strategic lever. They allow businesses to fund expansion, invest in research, or improve cash flow without diluting ownership. A startup might take on debt to develop a new product line; a manufacturer might finance machinery instead of buying it outright. These aren’t signs of weakness—they’re calculated steps toward growth.

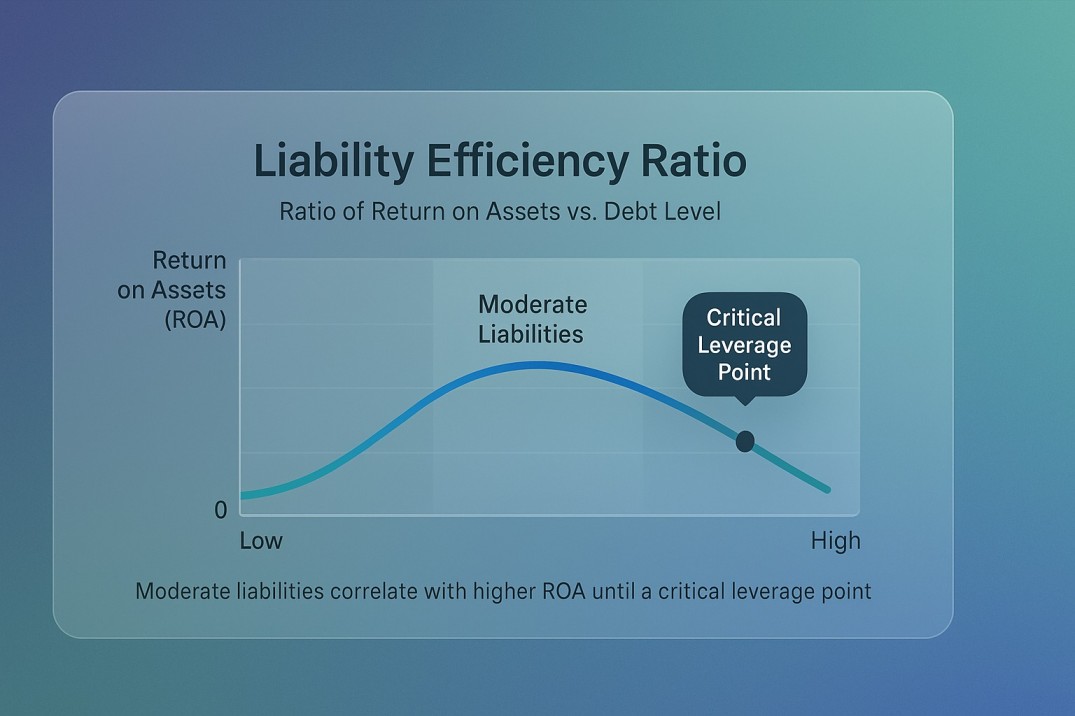

A company with zero liabilities may sound ideal, but it can also signal stagnation. It might indicate that the business is avoiding leverage entirely, missing opportunities that could have multiplied its value. Conversely, excessive liabilities can be a red flag, hinting at poor management or fragile liquidity. The art lies in finding balance—the point where obligations drive progress rather than suffocate it.

Liabilities as a Window into Financial Behavior

For investors, liabilities reveal more about a company’s character than its marketing ever could. They expose how management thinks about time, trust, and responsibility. The timing of liabilities—whether short-term or long-term—shows how a company plans its future.

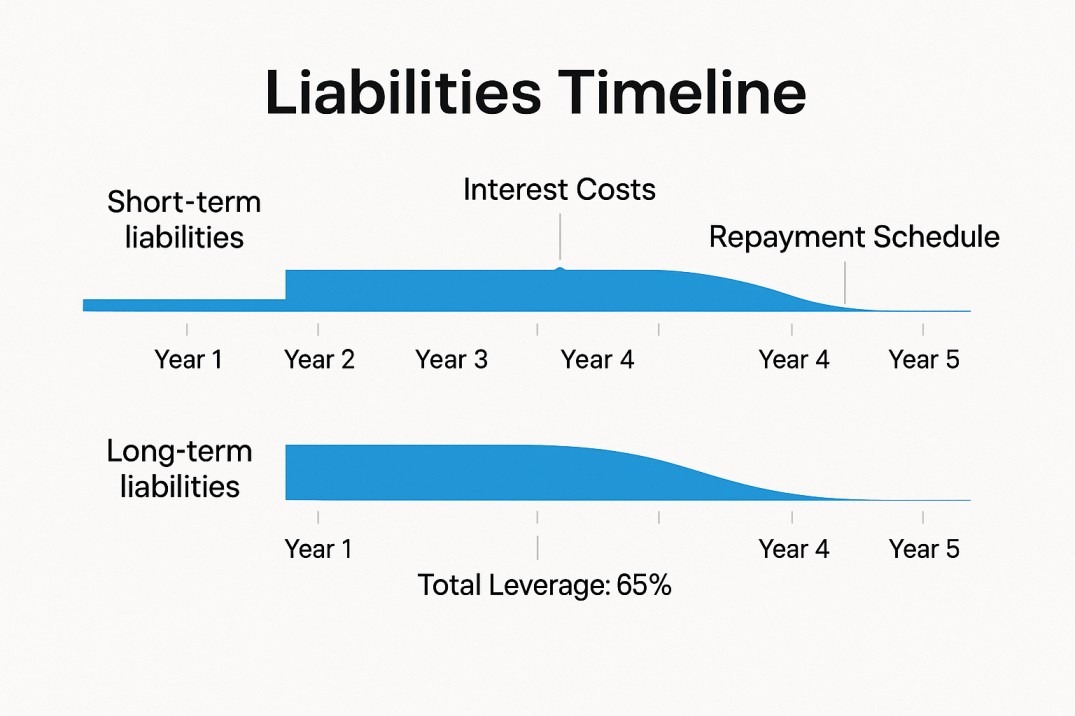

Short-term liabilities, such as accounts payable or accrued expenses, tell you how efficiently a company manages its day-to-day operations. They show whether a business pays its suppliers promptly or stretches terms to preserve cash. Long-term liabilities, like mortgages or bonds, expose a different story—commitments that signal confidence in future earnings and strategic foresight.

The mix between the two types offers a lens into risk appetite. A company relying too heavily on short-term liabilities might face liquidity problems if revenue slows. A company with well-structured long-term liabilities, however, shows an understanding of sustainable financing and trust from lenders.

How Liabilities Influence Valuation

Every investor wants to know what a company is truly worth. While assets capture what it owns, and profits reflect what it earns, liabilities reveal what it owes—and that directly affects valuation. The simplest way to see this is through the accounting equation:

Assets – Liabilities = Owner’s Equity.

Owner’s equity, or net worth, is the residual interest in a company after subtracting its liabilities. When liabilities rise faster than assets, equity shrinks, reducing the company’s book value. However, valuation isn’t just arithmetic—it’s perception, trust, and potential. A company with high liabilities but strong revenue growth can still command a premium if investors believe the borrowed money is fueling future expansion.

Take technology giants, for example. Many carry billions in liabilities, yet their valuations soar because those debts fund innovation, acquisitions, and global reach. What matters is not the presence of liabilities, but the reason behind them—and whether they’re generating more value than they cost.

The Hidden Cost of Ignoring Liabilities

Ignoring liabilities is like driving without checking the fuel gauge—you might move forward for a while, but reality will catch up. Unmanaged liabilities erode credibility with creditors, disrupt cash flow, and invite legal complications. Even more subtle are the opportunity costs. When too much of a company’s income goes toward interest payments, innovation budgets shrink, and strategic flexibility disappears.

Financial crises throughout history—from the 2008 collapse to smaller corporate bankruptcies—share a common root: unchecked liabilities that spiraled out of control. Companies borrowed beyond their earning capacity, betting on markets that didn’t hold. The lesson is not to fear liabilities, but to respect them. Smart management keeps obligations transparent, predictable, and proportional to future cash inflows.

Strategic Use of Liabilities in Growth

When used intelligently, liabilities can accelerate growth far beyond what equity alone could achieve. Borrowing allows a company to seize opportunities that would otherwise remain out of reach—expanding into new markets, scaling production, or investing in technology. This is why investors often celebrate “good debt.” It’s not the existence of liabilities that matters, but their purpose and payoff.

Consider a construction firm that takes a long-term loan to purchase equipment. The liabilities increase temporarily, but the machinery boosts project capacity and revenue. Within a few years, the debt pays for itself. This kind of liability doesn’t diminish value—it enhances it. The same principle applies across industries: leverage becomes a growth engine when paired with realistic projections and disciplined repayment plans.

Yet, it’s also true that markets punish overconfidence. When liabilities grow faster than the company’s ability to generate returns, value collapses. Analysts watch leverage ratios closely, not because they hate debt, but because they measure balance—the equilibrium between ambition and discipline.

Liabilities and the Human Side of Business

Beyond spreadsheets, liabilities shape company culture. They create pressure—but also discipline. When leadership knows that payments must be met, decisions become sharper, priorities clearer. Debt maturity dates act as silent mentors, reminding teams to deliver results on time.

On the flip side, excessive liabilities breed anxiety. Employees feel instability when financial obligations outweigh perceived stability. Creditors grow impatient. Managers chase short-term revenue just to meet payments, losing sight of innovation. That’s why financial communication matters—transparency about liabilities builds trust internally and externally. Stakeholders don’t demand perfection; they demand clarity.

Liabilities and the Future of Financial Reporting

The definition of liabilities is evolving. With sustainability and ESG (Environmental, Social, and Governance) priorities reshaping corporate reporting, new forms of obligations are emerging. Carbon credits, social commitments, and long-term environmental remediation costs are now part of the liability landscape.

In 2025 and beyond, financial statements won’t just list liabilities in monetary terms but also in ethical ones. A company’s debt to society—its unpaid environmental or social obligations—will factor into how investors assess true worth. Businesses that disclose these new liabilities openly will earn more trust, while those that hide them risk reputational damage that no profit margin can offset.

This redefinition aligns with a larger truth: liabilities aren’t just financial—they’re moral. Every contract, every borrowed dollar, every environmental impact carries an implicit promise. The companies that treat these promises seriously are the ones whose worth will endure.

Conclusion: The True Worth Behind Liabilities

In the end, liabilities don’t determine a company’s worth—they reveal it. They’re not marks of weakness but mirrors of intent. Each liability tells a story about choices, trade-offs, and trust. The healthiest companies aren’t those with the fewest liabilities, but those that manage them with foresight and integrity.

To decode a company’s value, you must read beyond the balance sheet. Look at how its liabilities are structured, why they exist, and whether they serve a higher goal than short-term profit. In finance, as in life, obligations define character. A company that honors and manages its liabilities with precision isn’t burdened—it’s balanced. And in that balance lies its true worth.

Andrea Balint is a writer and researcher focused on human behavior, workplace psychology, and personal growth. Through her work at CareersMomentum, she explores how mindset, leadership, and emotional intelligence shape modern careers. With a background in communication and HR development, she transforms complex ideas into practical insights that help readers build clarity, confidence, and professional purpose.