Negotiation is a multifaceted process that permeates various aspects of personal and professional life, significantly impacting outcomes ranging from formal business agreements to everyday interpersonal interactions. Whether negotiating salaries in tax jobs, securing client agreements, or settling disputes, negotiation serves as a cornerstone for achieving mutually beneficial outcomes, resolving conflicts, and fostering positive relationships. Successful negotiation is not merely about reaching an agreement; it’s about skillfully navigating through complexities, understanding diverse perspectives, and creating value for all parties involved.

Preparation

Thorough preparation is the bedrock of successful negotiation. This is especially true in tax jobs, where financial regulations, compliance issues, and industry trends must be carefully analyzed. It involves a comprehensive analysis of the subject matter, understanding one’s own priorities and objectives, and gathering pertinent information about the other party’s interests, goals, and potential constraints. This preparatory phase encompasses various tasks such as conducting market research, analyzing past negotiations, identifying potential alternatives, and formulating a well-defined negotiation strategy. The more informed and prepared negotiators are—particularly in tax jobs—the better equipped they are to steer the negotiation process toward favorable outcomes.

Active Listening

According to statistics, active listening is actively listen to a speaker, comprehend their message, respond thoughtfully, reflect on their words, and retain the information for future use.

Active listening is a fundamental skill in effective negotiation, particularly in tax jobs, where understanding client needs and regulatory concerns is crucial. It goes beyond merely hearing words; it involves attentively comprehending the underlying messages, concerns, and emotions conveyed by the other party. This entails paying close attention to both verbal and non-verbal cues, such as tone of voice, body language, and facial expressions. By actively listening, negotiators in tax jobs can gain valuable insights into their clients’ perspectives, needs, and motivations, which in turn facilitates the discovery of common ground and the development of mutually acceptable solutions.

Effective Communication

Clear and persuasive communication lies at the heart of successful negotiation, particularly in tax jobs, where professionals must convey complex financial concepts with clarity. It encompasses articulating one’s own ideas and proposals in a coherent and compelling manner while also actively engaging with the other party to understand their viewpoints and address their concerns. Effective communication in tax jobs involves choosing words thoughtfully, employing assertive language, and structuring arguments logically to enhance clarity and impact. Additionally, non-verbal communication cues such as gestures, posture, and eye contact play a crucial role in conveying confidence and credibility during negotiations.

Flexibility

While it is essential to remain steadfast in pursuit of one’s objectives, successful negotiators recognize the importance of flexibility and adaptability in achieving mutually beneficial outcomes. In tax jobs, professionals must be open to alternative solutions when structuring tax strategies or resolving disputes with clients and regulatory agencies. Flexibility entails being open to exploring alternative solutions, considering creative options, and making concessions when necessary to accommodate the interests of all parties involved. This adaptive approach enables negotiators in tax jobs to navigate through unexpected challenges, seize opportunities, and ultimately reach agreements that satisfy the underlying needs and priorities of both sides.

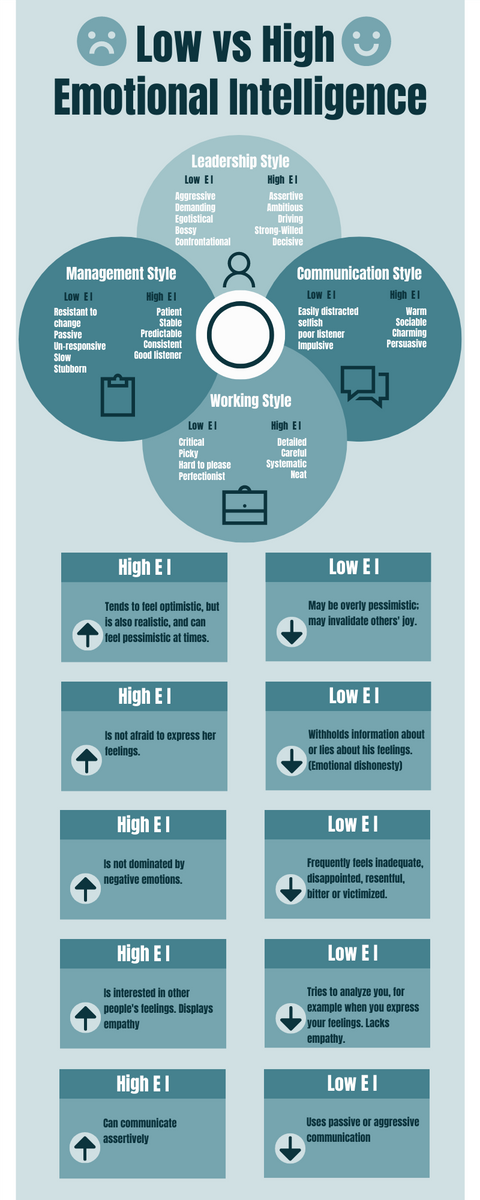

Emotional Intelligence

Emotional intelligence is a key determinant of negotiation success, especially in tax jobs, where maintaining client trust is crucial. It enables negotiators to effectively manage their own emotions and empathetically understand the emotions of the other party. Maintaining emotional composure, demonstrating empathy, and showing respect—even in the face of disagreement or conflict—are essential aspects of emotional intelligence in negotiation. By fostering a positive emotional atmosphere and building rapport based on trust and understanding, professionals in tax jobs can create an environment conducive to constructive dialogue and collaborative problem-solving.

Patience in Negotiation: A Key to Success in Remote Tax Jobs

Patience is a fundamental virtue in negotiation, especially in remote tax jobs, where financial complexities, client expectations, and legal regulations require meticulous discussions and careful deliberation. Successful negotiators understand that rushing through the process can lead to overlooked details, misunderstandings, or unfavorable agreements. Instead, they adopt a strategic approach, allowing ample time for thorough discussions, analysis, and decision-making.

Why Patience Matters in Remote Tax Jobs

In remote tax jobs, professionals frequently negotiate with clients, employers, and regulatory bodies regarding tax strategies, financial planning, or compliance matters. Given the virtual nature of these interactions, patience becomes even more crucial, as digital communication can sometimes lead to delays, misunderstandings, or misinterpretations. By maintaining a patient mindset, tax professionals can navigate these challenges effectively and ensure all parties involved have a clear understanding before finalizing agreements.

Resisting the Urge to Rush Negotiations

One of the common pitfalls in negotiation is the temptation to rush decisions to reach a quick resolution. However, in remote tax jobs, hasty decisions can lead to compliance issues, financial discrepancies, or overlooked legal risks. Skilled negotiators recognize the importance of taking the necessary time to evaluate all available options, consider potential consequences, and ensure the best possible outcome.

Overcoming Pressure Tactics with Patience

Negotiation often involves pressure tactics from the other party, such as tight deadlines, ultimatums, or high-stakes decision-making. Professionals in remote tax jobs must remain composed and resist the urge to make snap judgments under pressure. Instead, they should focus on their objectives, analyze the situation rationally, and use strategic patience to counteract any aggressive negotiation tactics.

Facilitating Meaningful Exchanges

Patience allows negotiators to engage in productive and meaningful exchanges. In remote tax jobs, tax professionals frequently deal with clients who may have varying levels of financial knowledge. Some clients may need additional time to understand tax regulations, financial implications, or compliance requirements. By practicing patience, tax professionals can guide their clients effectively, answer questions thoroughly, and build trust through clear and transparent communication.

Navigating Virtual Communication Challenges

Working in remote tax jobs comes with its own set of communication challenges, including time zone differences, email delays, and virtual meeting constraints. Unlike in-person negotiations, where body language and immediate feedback play a significant role, remote professionals must exercise additional patience to ensure clear, effective communication. Waiting for responses, clarifying complex financial matters, and addressing concerns systematically can help prevent miscommunication and foster stronger professional relationships.

Long-Term Benefits of Patience in Remote Tax Jobs

Patience is not just about enduring prolonged negotiations—it is a strategic tool that leads to sustainable, long-term success. In remote tax jobs, patient negotiators build a reputation for being reliable, thorough, and professional. Clients, employers, and partners value a tax professional who takes the time to assess situations carefully, weigh options, and make well-informed decisions. This reputation can lead to long-term business relationships, increased job opportunities, and greater career advancement in the tax industry.

Developing Patience as a Remote Tax Professional

Practicing patience in remote tax jobs requires conscious effort and strategy. Here are some key ways tax professionals can cultivate patience in their negotiations:

Manage Expectations – Set clear expectations with clients and stakeholders regarding timeframes and the negotiation process.

Set Realistic Timelines – Allow ample time for discussions, revisions, and decision-making to avoid rushed agreements.

Stay Calm Under Pressure – Maintain composure in challenging negotiations and focus on achieving favorable outcomes.

Actively Listen – Give clients and colleagues the time they need to express concerns and provide necessary information.

Use Strategic Pauses – Allow space for thoughtful consideration rather than responding impulsively.

Creativity

Creative thinking is a valuable asset in negotiation, particularly in tax jobs, where professionals must devise innovative tax-saving strategies. By thinking outside the box, brainstorming new ideas, and considering unconventional approaches, negotiators can uncover opportunities for value creation and mutual gain. Creativity encourages negotiators in tax jobs to challenge assumptions, break through stalemates, and devise win-win solutions that address the underlying interests and aspirations of all parties involved.

Mastering Negotiation Tactics for Success in Turbo Tax Careers

Negotiation is a fundamental skill in the tax industry, influencing everything from client agreements to salary discussions and contract terms. Professionals in Turbo Tax careers must be well-versed in various negotiation tactics to navigate complex financial scenarios, ensure compliance, and achieve favorable outcomes. However, effective negotiation is not just about using tactics—it is about employing them strategically, ethically, and with integrity.

Why Negotiation Tactics Matter in Turbo Tax Careers

In Turbo Tax careers, professionals frequently engage in negotiations with clients, employers, and financial institutions. Whether discussing tax settlements, service fees, or tax-saving strategies, having a strong grasp of negotiation techniques can make a significant difference in achieving mutually beneficial agreements. A well-negotiated outcome not only enhances professional credibility but also fosters long-term client relationships and business growth.

Key Negotiation Tactics for Turbo Tax Professionals

1. Anchoring: Setting the Initial Offer

Anchoring is a powerful negotiation tactic that involves establishing an initial reference point, such as a proposed tax settlement amount or service fee. In Turbo Tax careers, professionals often use anchoring to guide discussions in their favor. By setting an initial offer strategically—whether it’s a fee structure for tax consulting services or a proposed tax liability reduction—they can shape the negotiation parameters from the outset.

2. Mirroring: Adapting to Client Communication Styles

Mirroring involves subtly mimicking the communication style, tone, and body language of the other party to build rapport and trust. In Turbo Tax careers, professionals who master mirroring can create a sense of familiarity and comfort with clients, leading to smoother negotiations and higher client satisfaction.

3. Framing: Presenting Proposals in a Favorable Light

Framing is a negotiation technique that focuses on presenting information in a way that highlights the most favorable aspects of a proposal. In Turbo Tax careers, professionals frequently use framing to position tax solutions, compliance strategies, and fee structures in a manner that appeals to clients.

4. Silence as a Negotiation Tool

Silence is an underrated yet powerful tactic in negotiations. In Turbo Tax careers, knowing when to pause can encourage the other party to fill the silence, potentially revealing valuable insights or making concessions.

5. The “Good Cop, Bad Cop” Strategy

This classic negotiation tactic involves one party taking a tough stance (bad cop) while another adopts a more understanding and cooperative role (good cop). In Turbo Tax careers, professionals working in teams can use this approach to manage client expectations and steer negotiations in their favor.

6. The Decoy Effect: Offering a Strategic Alternative

In Turbo Tax careers, professionals can use the decoy effect by presenting an alternative option that makes their preferred choice more attractive. This strategy works particularly well when structuring service packages.

Ethical Use of Negotiation Tactics in Turbo Tax Careers

While negotiation tactics can be highly effective, professionals in Turbo Tax careers must use them ethically. Manipulative or coercive tactics can damage trust, harm professional reputation, and lead to legal or compliance risks. Maintaining transparency, fairness, and integrity in negotiations ensures long-term success and client satisfaction.

Best Practices for Ethical Negotiation:

- Be Honest: Present accurate financial information and avoid misleading claims.

- Prioritize Win-Win Solutions: Aim for agreements that benefit both parties.

- Maintain Professionalism: Even in difficult negotiations, professionalism fosters respect and credibility.

- Respect Client Interests: Understand client concerns and offer solutions that align with their needs.

Building Long-Term Success Through Negotiation in Turbo Tax Careers

Effective negotiation is a skill that tax professionals must continually refine. In Turbo Tax careers, mastering negotiation tactics can lead to better client relationships, improved financial outcomes, and career advancement. By employing techniques such as anchoring, mirroring and strategic silence while maintaining ethical standards, tax professionals can navigate complex negotiations with confidence and success.

Whether negotiating fees, tax settlements, or client agreements, those who approach negotiation with preparation, strategy, and integrity will thrive in Turbo Tax careers and achieve long-term professional growth.

Risk Assessment

Conducting a thorough risk assessment is an integral part of effective negotiation strategy, especially in tax jobs, where legal and financial implications can be significant. This involves evaluating the potential risks and consequences associated with different negotiation outcomes, including financial, legal, reputational, and relational considerations. By identifying potential pitfalls and developing contingency plans to mitigate unfavorable scenarios, tax professionals can negotiate with confidence and minimize potential downsides. Proactive risk management enables negotiators in tax jobs to anticipate challenges, adapt their strategies accordingly, and safeguard their interests throughout the negotiation process.

Continuous Learning

Negotiation is a dynamic and evolving skill that can be continually refined and improved through ongoing learning and professional development. In tax jobs, staying updated on changes in tax laws, financial regulations, and negotiation best practices is critical for success. Reflecting on past negotiation experiences, seeking feedback from peers and mentors, and participating in negotiation training programs or workshops are valuable avenues for enhancing negotiation skills. By embracing a mindset of continuous learning and self-improvement, negotiators in tax jobs can stay abreast of emerging trends, incorporate best practices, and adapt their approaches to achieve optimal outcomes in an ever-changing negotiation landscape.

Tips for Crafting a Compelling Salary Negotiation Mail

Negotiating salary through mail requires careful planning and execution. Here are some additional tips to enhance the effectiveness of your communication:

- Be Clear and Concise: Keep your mail focused and avoid unnecessary details or ambiguity.

- Professional Tone: Maintain a formal and respectful language throughout your communication.

- Highlight Your Value Proposition: Emphasize how your skills, experience, and achievements align with the company’s objectives and why you deserve the proposed salary.

- Personalize Your Approach: Tailor your mail to the specific recipient and context, referencing details about the job offer, promotion, or role being negotiated.

- Proofread Thoroughly: Ensure your mail is free of grammatical errors and typos to uphold professionalism and credibility.

Exmple for Salary Negotiation Email:

Subject: Performance feedback – follow up

Dear James,I hope you are well.

Thank you for your recent feedback on my performance to date with GLR Financials. I am pleased to hear that you are satisfied with my abilities. I genuinely believe I am a solid asset to the team with my experience working in finance as a data analyst over the past five years. I look forward to continuing to provide critical insights to shape GLR Financials’ business strategy.

Based on my performance, I would like to discuss a review of my current salary. Over the last 12 months, my responsibilities have included analysing trends and providing insights that have shaped business decisions and helped improve results. To date, the insights I developed have helped to launch into a new market that generated a 25% increase in overall revenue for the business.

Given my experience and proven success within the finance industry specifically, I feel that a salary between $95,000 and $105,000 is more in line with my skills and experience. This is slightly more than my current salary of $85,000. This salary also reflects current market averages for data analysts in our area.

Thank you for your consideration. Please can you let me know a suitable time that we can meet to discuss further. I look forward to hearing from you.

Sincerely,

Ben Thompson

text source: indeed.com

Follow Up

After sending your negotiation email, be proactive in following up with the employer if you don’t receive a response within a reasonable timeframe. A polite and concise follow-up email reiterating your interest in discussing the terms further demonstrates your commitment and professionalism. Be patient and allow the employer sufficient time to consider your request and respond accordingly.

Closure

Mastering the art of negotiation is an indispensable skill for navigating through the complexities of modern life, whether in the realm of business, diplomacy, or personal relationships. For professionals in tax jobs, negotiation plays a pivotal role in salary discussions, client interactions, tax settlements, and contract agreements. By honing their skills in preparation, patience, creativity, negotiation tactics, risk assessment, and continuous learning, individuals in tax jobs can elevate their negotiation prowess and achieve mutually beneficial outcomes while fostering positive and enduring relationships.

Andrej Fedek is the creator and the one-person owner of two blogs: InterCool Studio and CareersMomentum. As an experienced marketer, he is driven by turning leads into customers with White Hat SEO techniques. Besides being a boss, he is a real team player with a great sense of equality.