In the vast landscape of online transactions, PayPal has long been a stalwart, providing a reliable and secure platform for individuals and businesses worldwide. However, as technology evolves and user preferences shift, the demand for alternatives to PayPal has grown. Whether due to fees, account restrictions, or specific business needs, many users are exploring other platforms that offer similar functionalities and flexibility. In this comprehensive guide, we’ll delve into 30 of the best PayPal online transaction alternatives, each catering to different aspects of online transactions, from international payments to subscription billing and cryptocurrency support.

Table of Contents

- 1. Square

- 2. TransferWise (now Wise)

- 3. Payoneer

- 4. Skrill

- 5. Google Pay

- 6. Apple Pay

- 7. Amazon Pay

- 8. Authorize.Net

- 9. 2Checkout

- 10. PayPal Alternatives for Cryptocurrency:

- 11. Venmo

- 12. Shopify Payments

- 13. Dwolla

- 14. Worldpay

- 15. Paddle

- 16. Payza

- 17. WePay

- 18. Braintree

- 19. Paysera

- 20. Adyen

- 21. Klarna

- 22. Neteller

- 23. Zelle

- 24. Stripe

- 25. Stripe Alternatives:

- 26. Revolut

- 27. Dwolla

- 28. FastSpring

- 29. Payline

- 30. Zoho Checkout

- Conclusion

1. Square

Square has revolutionized payment processing for small businesses with its suite of tools, including point-of-sale (POS) systems, invoicing solutions, and e-commerce integrations. It caters to brick-and-mortar stores, online sellers, and service providers, offering easy-to-use platforms and transparent pricing.

2. TransferWise (now Wise)

For individuals and businesses dealing with international transactions, Wise (formerly TransferWise) is a game-changer. It offers competitive exchange rates, low fees, and transparency in currency conversions, making it a preferred choice for freelancers, remote workers, and global businesses.

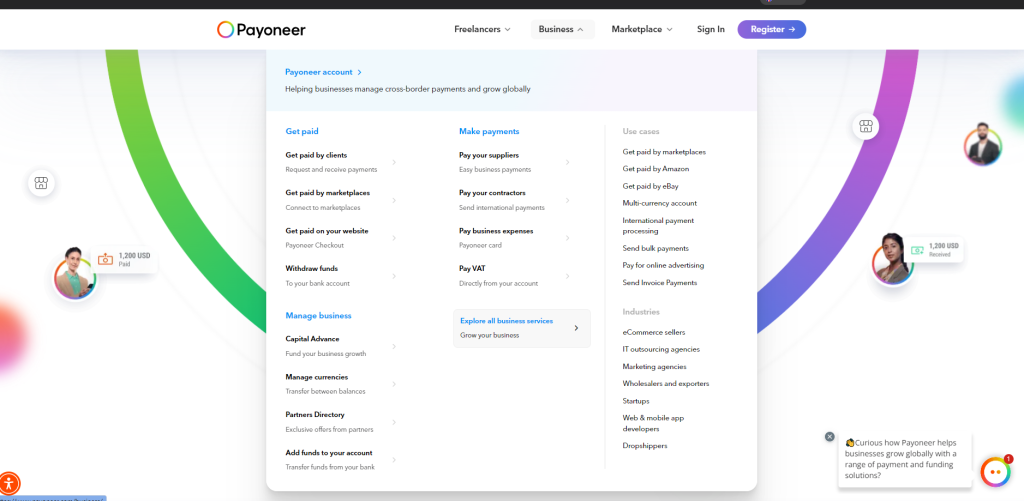

3. Payoneer

Payoneer specializes in global payments, providing businesses and professionals with cross-border payment solutions, prepaid cards, and e-wallet services. It’s a popular choice among freelancers, affiliate marketers, and e-commerce sellers who operate on an international scale.

4. Skrill

Skrill offers a versatile platform for online payments, money transfers, and cryptocurrency support. With its focus on user convenience and security, Skrill has gained a loyal user base across various industries, including gaming, e-commerce, and digital services.

5. Google Pay

Integrated with Google’s ecosystem, Google Pay streamlines payments across Google services, online merchants, and in-store purchases. Its simplicity and security make it a convenient option for Android users and anyone with a Google account.

6. Apple Pay

Apple Pay leverages Apple’s ecosystem to facilitate secure and contactless payments on iOS devices, Macs, and even in-app purchases. With its emphasis on privacy and ease of use, Apple Pay has gained traction among Apple device users worldwide.

7. Amazon Pay

Utilizing the trust and reach of Amazon, Amazon Pay enables seamless payments, subscriptions, and one-click checkouts on participating websites and apps. It leverages Amazon’s customer base and familiarity to enhance the online shopping experience.

8. Authorize.Net

As a leading payment gateway, Authorize.Net provides businesses with secure and reliable payment processing solutions. It supports various payment methods, recurring billing, and fraud prevention tools, making it a trusted choice for e-commerce ventures.

9. 2Checkout

2Checkout (now Verifone) caters to businesses seeking global payment solutions with support for multiple currencies and payment methods. Its customizable checkout options and subscription management tools make it suitable for digital goods and subscription-based businesses.

10. PayPal Alternatives for Cryptocurrency:

Coinbase

Coinbase is a renowned platform for buying, selling, and managing cryptocurrencies such as Bitcoin, Ethereum, and more. It offers a user-friendly interface, wallet services, and trading features for cryptocurrency enthusiasts and investors.

BitPay

BitPay specializes in facilitating Bitcoin and cryptocurrency payments for businesses, providing tools for invoicing, payment acceptance, and fund settlements in digital currencies.

11. Venmo

Owned by PayPal, Venmo focuses on peer-to-peer payments and social interactions, making it popular among friends, family members, and small-scale transactions. Its social feed feature adds a social element to payment activities.

12. Shopify Payments

Integrated within the Shopify e-commerce platform, Shopify Payments streamlines checkout processes for online stores. It offers competitive rates, fraud protection, and seamless integration with Shopify’s other features.

13. Dwolla

Dwolla caters to businesses in need of ACH (Automated Clearing House) transfers, bank account payments, and mass payouts. Its focus on bank-to-bank transfers and customizable payment solutions makes it a preferred choice for certain industries.

14. Worldpay

Worldpay provides a range of payment solutions for businesses, including online payments, POS systems, and fraud prevention tools. Its global reach and industry-specific solutions make it a reliable partner for businesses of all sizes.

15. Paddle

Paddle specializes in payment processing and subscription management for digital product sellers. It offers features like localized checkout, revenue analytics, and licensing control, catering to software developers and SaaS companies.

16. Payza

Payza facilitates online payments, money transfers, and currency exchanges across borders. Its global presence and support for multiple languages and currencies make it accessible to a diverse user base.

17. WePay

WePay focuses on providing payment solutions for platforms and marketplaces, offering easy integration, payment processing, and compliance tools. It caters to businesses operating within shared economies and online marketplaces.

18. Braintree

Owned by PayPal, Braintree offers customizable payment solutions for businesses of all sizes. Its features include recurring billing, mobile payments, and fraud protection, making it suitable for e-commerce ventures and subscription services.

19. Paysera

Paysera provides payment processing services, e-wallet solutions, and prepaid cards for businesses and individuals. With a focus on security, convenience, and international online transaction, Paysera serves a diverse customer base.

20. Adyen

Trusted by major brands globally, Adyen offers comprehensive payment processing and risk management services. Its omnichannel capabilities, global reach, and advanced fraud detection make it a preferred choice for enterprise-level businesses.

21. Klarna

Klarna is renowned for its “buy now, pay later” options, allowing customers to split payments or defer them for a later date. It’s popular among online retailers and shoppers seeking flexible payment solutions and a seamless checkout experience.

22. Neteller

Neteller caters to users looking for secure online transaction, payments and prepaid cards. Its focus on gaming, forex trading, and e-commerce makes it a preferred choice for certain industries and regions.

23. Zelle

Zelle is a peer-to-peer payment platform used by many banks in the United States, enabling users to send money quickly and securely between bank accounts. Its integration with banking apps simplifies fund transfers for individuals and businesses.

24. Stripe

Stripe stands out as a top contender in the online payment space, especially for businesses. Its developer-friendly APIs, robust security features, and seamless checkout experience have made it a favorite among startups and established enterprises alike. With support for various payment methods and currencies, Stripe simplifies online transactions and subscription billing.

25. Stripe Alternatives:

Recurly

Recurly specializes in subscription billing and management, offering customizable plans, revenue analytics, and dunning management for subscription-based businesses.

Chargebee

Chargebee provides subscription billing solutions with features like automated invoicing, pricing flexibility, and integrations with popular payment gateways, making it a preferred choice for SaaS companies and subscription services.

26. Revolut

Revolut offers multi-currency accounts, international money transfers, and banking services with competitive exchange rates and low fees. Its mobile app and digital banking features appeal to travelers, expatriates, and global businesses.

27. Dwolla

Dwolla’s focus on ACH payments, bank transfers, and white-label payment solutions makes it a preferred choice for businesses needing secure and efficient payment processing. Its API-driven platform enables seamless integrations and custom workflows.

28. FastSpring

FastSpring specializes in e-commerce solutions for digital goods, software, and subscription services. It offers features like global payments, subscription management, and order fulfillment, catering to digital businesses of all sizes.

29. Payline

Payline provides payment processing solutions for businesses, emphasizing security, reliability, and customer support. Its offerings include online payments, POS systems, and industry-specific solutions for retail, healthcare, and more.

30. Zoho Checkout

As part of Zoho’s suite of business tools, Zoho Checkout enables businesses to accept online transaction, set up subscriptions, and manage customer billing seamlessly. Its integration with Zoho’s ecosystem adds value for businesses using Zoho’s other products.

Conclusion

The landscape of online transactions is rich with options beyond PayPal, catering to diverse needs and preferences across industries and regions. Whether you’re a small business owner, an e-commerce entrepreneur, or a global enterprise, these 30 PayPal alternatives for online transaction offer a range of features, from seamless checkout experiences and subscription billing to international payments, cryptocurrency support, and fraud prevention tools. By evaluating factors such as fees, supported currencies, integration options, and security features, you can choose the best payment solution that aligns with your business goals and enhances the overall customer experience.

Andrej Fedek is the creator and the one-person owner of two blogs: InterCool Studio and CareersMomentum. As an experienced marketer, he is driven by turning leads into customers with White Hat SEO techniques. Besides being a boss, he is a real team player with a great sense of equality.