Artificial Intelligence (AI) has emerged as a transformative force in various sectors, revolutionizing traditional processes and driving innovation. In the realm of finance, where talent acquisition and retention are critical for success, AI is playing an increasingly pivotal role in shaping recruitment practices. By leveraging advanced algorithms, data analytics, and machine learning capabilities, financial institutions are redefining how they identify, assess, and onboard top talent. This article explores in depth how AI is transforming recruitment practices in the finance sector, examining its impact on talent sourcing, candidate assessment, diversity promotion, predictive analytics, and succession planning.

Table of Contents

AI-Powered Talent Sourcing

The traditional approach to talent sourcing often involves manual screening of resumes, lengthy interviews, and subjective decision-making. However, AI-powered platforms are revolutionizing this process by automating candidate search and qualification. These platforms use natural language processing (NLP) algorithms to analyze job descriptions and candidate profiles, identifying relevant skills, experiences, and qualifications. By leveraging big data and predictive analytics, AI tools can match candidates to job requirements with unprecedented speed and accuracy.

Furthermore, AI-driven talent sourcing extends beyond job boards and professional networks. It taps into passive candidate pools, analyzes social media activity, and tracks industry trends to identify potential candidates who may not be actively seeking employment. This proactive approach not only accelerates the recruitment timeline but also ensures a more comprehensive talent search, leading to better hiring outcomes for finance firms.

Enhanced Candidate Assessment through AI

Traditional interviews and assessments often have inherent biases and limitations in evaluating candidates’ true potential and fit for specific roles. AI-powered assessment tools address these challenges by providing objective and data-driven insights into candidates’ capabilities. For instance, AI-driven video interview platforms can analyze facial expressions, tone of voice, and language patterns to assess candidates’ communication skills, emotional intelligence, and cultural fit.

Moreover, AI algorithms can administer cognitive and behavioral assessments tailored to finance-related roles. These assessments measure candidates’ problem-solving abilities, analytical skills, risk management acumen, and ethical decision-making, among other competencies. By incorporating AI in candidate assessment, finance firms can make informed hiring decisions, reduce unconscious biases, and ensure a fair and standardized evaluation process.

Promoting Diversity and Inclusion

Diversity and inclusion (D&I) have become strategic imperatives for modern organizations, including those in the finance sector. AI technologies play a pivotal role in promoting D&I by mitigating biases and fostering a more inclusive recruitment process. AI algorithms can analyze historical hiring data to identify patterns of bias, such as gender or racial biases, in candidate selection and promotion decisions.

Furthermore, AI-driven tools can anonymize candidate information during initial screenings, focusing solely on qualifications and skills to minimize unconscious biases. These tools can also suggest diverse candidate pools based on objective criteria, helping finance firms build more inclusive teams that reflect a variety of backgrounds, experiences, and perspectives. By leveraging AI for D&I initiatives, finance institutions can enhance innovation, creativity, and decision-making within their workforce.

AI in Predictive Analytics and Succession Planning

Predictive analytics powered by AI is another game-changing aspect of recruitment in finance. AI algorithms can analyze vast amounts of employee data, including performance metrics, tenure, training history, and career trajectories. By identifying patterns and correlations, AI can predict which employees are high-potential candidates for leadership roles or key positions within the organization.

This predictive capability enables finance firms to develop targeted succession plans and talent development strategies. By nurturing internal talent and providing growth opportunities, organizations can enhance employee retention, motivation, and loyalty. Moreover, AI-driven predictive analytics can forecast future hiring needs based on business trends, market dynamics, and organizational goals, allowing finance institutions to proactively address talent gaps and strategic workforce planning.

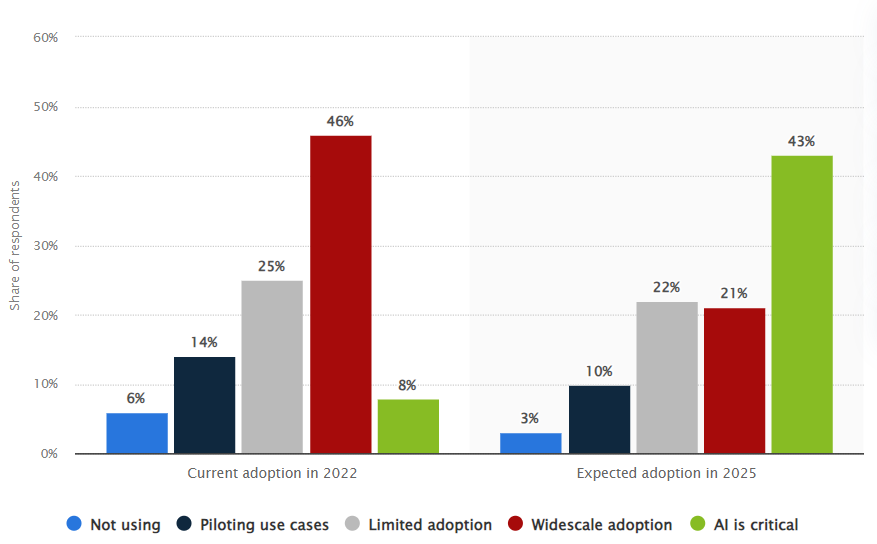

Artificial intelligence (AI) adoption rate in financial businesses worldwide in 2022 and 2025

source of statistic: statista.com

Challenges and Considerations in AI-Driven Recruitment

While AI offers immense potential in transforming recruitment practices, it also presents challenges and considerations that finance firms must navigate effectively. One significant concern is the ethical use of AI, particularly regarding data privacy, algorithmic biases, and fairness in decision-making. Financial institutions must ensure transparency, accountability, and compliance with data protection regulations when implementing AI-driven recruitment technologies.

Moreover, there may be resistance or skepticism among employees and candidates regarding AI’s role in recruitment. Clear communication, training, and education about AI technologies and their benefits are essential to build trust and acceptance within the organization and among job seekers. Additionally, finance firms must continually monitor and evaluate AI algorithms to mitigate biases, ensure algorithmic fairness, and uphold ethical standards throughout the recruitment process.

Conclusion

In conclusion, AI is a transformative force in reshaping recruitment practices in the finance sector. By harnessing AI-powered tools and analytics, financial institutions can optimize talent sourcing, enhance candidate assessment, promote diversity and inclusion, and strategically plan for succession and talent development. While challenges exist, proactive measures in ethical AI implementation, transparency, and ongoing training can maximize the benefits of AI in recruitment while mitigating potential risks. As AI continues to evolve, its role in finance recruitment will likely expand, driving innovation, efficiency, and competitiveness in the dynamic landscape of financial services.

Andrej Fedek is the creator and the one-person owner of two blogs: InterCool Studio and CareersMomentum. As an experienced marketer, he is driven by turning leads into customers with White Hat SEO techniques. Besides being a boss, he is a real team player with a great sense of equality.